Stratus Computer

The Gimmick

Computers that don’t break.

My elevator pitch for Stratus was: “We make computers that don’t break.” I thought it was perfect — short and sweet. In the early ’80s my pitch almost always caused a chuckle or laugh. Computer systems were notoriously unreliable — people expected them to “break”. Just a few years earlier when I worked for Data General I listened to my boss tell the CEO of Hyster (the fork lift company) to calm down — stop complaining about the Novas that we were selling them. Of course they crash all the time — they’re computers, and computers break!!!

In the early history of computing, the user – the ultimate recipient of its work — never saw the thing. One of their earliest uses was during World War II to compute range tables for the soldiers shooting giant guns. Those guys obviously never saw the computer that produced all information that allowed them to point these guns in the proper direction, adjust the elevation for distance, factor in wind, humidity, etc. This was all done by hand until computers came along.

In the ‘50s and most of the ‘60s computers were used in what was called “batch processing.” The inputs into the computer, usually in the form of punched cards, were placed in a cubbyhole in a room somewhere in its vicinity. At some point during the next 24 hours or so the operator would feed these cards into the computer, it would execute the job and print the results, and the operator would place the output back in the same cubbyhole. And voilà! The job was done. The computer user never touched or even laid eyes on the “brain”.

The first computer I ever saw was an IBM 1620 at San Jose State in 1963. It was actually a pretty awe-inspiring moment for me. I entered the computing room and there it was! Out of reach behind a glass wall. The computer. The Brain. The mysterious giant brain that predicted the presidential election in the 50s, and forced Tom Watson of IBM to finally get serious about the business. (He couldn’t stand all the free publicity that UNIVAC was getting.) I was taking a math class and had to learn FORTRAN, the world’s first high level programming language. I would punch up bunch of cards, place them in a cubbyhole, and come back the next day to get the results. More often than not I made some stupid error in one of the first cards and the whole effort was wasted. I would do it again and wait another day for the results. This was how almost everybody used computers — no one actually touched them.

As computers moved into the commercial world during the 1960s one of the most frequent applications was calculating and printing payroll checks. A great way for big companies to cut costs. If perhaps during the operation the computer failed – and they failed pretty often back then – the payroll person never knew it. The problem would be fixed by the operator or service engineer, the computer would be rebooted, and the payroll program would be rerun. The person that picked up the bundle of checks never knew.

In the late 60s and early 70s things began to change. Companies began to use computers in applications where the ultimate user was connected directly to it. A great example was ATM machines. In the early 1970s banks began installing them as way to save money. If they could get people use these ATMs for simple banking transactions they could get away with fewer employees and maybe even close down some branches. For example, Citibank in New York City had a network of 500 ATMs all connected to a central mainframe computer that held customer account information. This was a revolutionary application. If the customer wanted to withdraw cash from his checking account she could do it from the ATM and never have to go into a branch. Revolutionary at the time!!!

It was a big problem when the inevitable crash happened. Reliability problems were caused partly by hardware failures and partly by software bugs. The cause didn’t matter — the problem was now Citibank had 500 ATMs that were down. Citibank had a bunch of unhappy customers. Something had to change if networks of ATMs were really going to work.

Enter Tandem Computers of Cupertino California. Tandem was the first company to come out with a successful so-called fault-tolerant computer. The name they gave to the system was “Nonstop.” Pretty cool name.

In 1977 I hated Tandem. Well, hated isn't quite correct – but I was extremely jealous of its people. I could have been one of the founders and I felt I had totally screwed up a once in a lifetime golden opportunity. I had a pain in my belly that was eating away for a full two years, and ultimately that pain caused me to quit Data General in 1979 and to form what ultimately became Stratus Computer.

A very small number of people know the true story of how Tandem was started. The group is getting smaller with the recent passing of Tom Perkins. Here’s what happened — it’s different than the “official” Tandem version.

In 1973 I was sitting around fat dumb and happy at my desk in my cubicle at Hewlett-Packard. I was, in all modesty, star at HP. Only 29 years old and in charge of all research and development for their exciting young computer division. Now, to be fully truthful it wasn’t that unusual to have a youngster at HP with so much responsibility. Like many tech companies in The Valley back then it was very rare to bring in a seasoned person to do a big job. The pattern at companies like Fairchild, National Semiconductor, Varian, Intel, HP and suchlike was to hire fresh outs with engineering or technical degrees and turn them loose. At some point these kids would have to decide between the management track or the technical track. Are you going to remain an engineer and continue to create or are you going to become a manager?

Well, due to a whole series of events that I cover in my Hewlett-Packard chapter I wound up with a really big job at a really young age. I was feeling pretty good about myself – beautiful wife, three great kids, really nice ranch-style house in the upper-middle-class town of Saratoga in the Valley. I was well thought of by my bosses and figured one day I would be a VP at Hewlett-Packard. I was a rising star. The sky was the limit.

During the fall of that year I got a rather mysterious phone call. I heard the words “hi Bill, this is Jim Treybig.” I knew Jim – he used to work in the marketing department at HP. I knew that he had left a few months earlier to join Tom Perkins in a brand new venture capital firm. But Jim and I were never close friends or close working buddies – we just had a casual acquaintanceship.

“Tom and I would like to meet you for lunch to talk about an exciting opportunity. But it has to be someplace quiet – we don’t want anyone to see us.” Hmmmmm. Sounds mysterious. Sounds interesting. I was very impressed that Tom Perkins even knew who I was. This was not something that I would want to pass up.

Tom Perkins was sort of a rock star around us young folks at HP. When I joined in 1969 he was the division manager of the Cupertino Division, which manufactured their new minicomputer line. He was relatively young, around 40, good looking and rich. I remember one day when the stock market had a big downturn someone mentioned that Perkins had lost $1 million. How on earth could anyone to be worth enough money to lose million dollars! It was beyond my imagination. Now and then he would walk into the research lab (HP had this thing about “managing by walking around”) and he would chew the fat with us engineers. I don’t think during that time I ever actually spoke to him so the idea of having lunch with Perkins to talk about an exciting deal was amazing to me.

We met at a dark little restaurant near De Anza College, right down the road. It was just Perkins, Treybig, and myself. I was feeling pretty cool to be in the company of the great man. Jim got right to the point. He told me that a couple of guys out of the telecommunications industry in Southern California had approached them with the idea of starting a computer company. Not just any type of company. Their idea was to bring fault tolerance to the commercial world. In other words, to greatly improve the availability of computing technology for the new types of online applications that were getting started, such as ATM networks.

These guys had a lot of experience in fault tolerance since the telco world had been doing this forever. AT&T, affectionately known as Ma Bell at the time, had a paranoid attitude about the availability of their network. For many years — decades in fact — many of their systems were designed to work in “tandem” so that if there was a failure the phone system did not die. Even as a young kid I remembered that when all else failed – electricity, water, or all of your services – when you picked up the phone you always got a dial tone. In fact I couldn’t remember of ever being unable to place a phone call — in my entire short life!

Perkins told me how excited he was about this possible new venture. He said “ever since my time at HP I’ve wanted to start a computer company. This might be my chance.”

They asked me to come to the Kleiner Perkins office – at 3000 Sand Hill Road in Menlo Park, the most famous venture capital address in the world – and listen to a presentation by these two young engineers. They told me that Fred Coury would also be there. Fred was a hardware guy who had left HP a little earlier and started a hardware consulting business. Fred was the hardware expert, I was the software guy. They never told me exactly what my job would be if things progressed but I assume I would either be in charge of software development or of the entire project.

So, I decided to take some vacation time and meet with them. In my mind I gave the whole thing little chance of success – at least not much chance of me being involved. I was very happy at HP. I considered myself a star. Also, I did not think that “normal” people like Treybig and myself could start a computer company. I figured it took luminaries like Bill Hewlett and Dave Packard. But, it never hurts to listen. I continued on.

A few days later I visited the Kleiner Perkins office and had a chance to meet Gene Kleiner. I didn’t know much about him except that he was revered in the Santa Clara Valley. (It wasn’t yet commonly referred to as Silicon Valley.) Years later I learned Kleiner was part of the “traitorous eight” that left William Shockley, the inventor of the transistor, to form Fairchild Semiconductor in the late 1950s. This whole experience was very cool for me – I had never been inside a venture capital office, and I got to meet Gene Kleiner.

Treybig, Coury, and I met the two entrepreneurs in a conference room. (I don’t remember whether or not Perkins was there.) Their idea was to connect two or more computers together with a very high speed bus. The programs running on these computers would take turns backing each other up. It was called “checkpointing”, a term that I was already familiar with. Every now and then a running program would checkpoint – or send – it’s internal state over to another computer, so that if it crashed all would not be lost – the other computer could carry on from the last checkpoint.

These computer systems, and the software running on them, would be focused at commercial applications, not telecommunications. This would be unique — a computer system running business applications with equivalent reliability of the telephone network.

It was a cool meeting as far as I was concerned, and we all agreed to get together again in a few days. I learned at the next meeting that these two engineers had not yet defined the instruction set for the computers. This bothered me a little bit because I knew from my Hewlett-Packard experience how challenging it was to invent a new instruction set. It never occurred to me that the best solution was to “borrow” instructions from an existing computer such as the HP 3000. Looking back, I’m amazed that I never thought this.

At our final meeting Treybig tried asked me to put together a work schedule showing how many people and how long it would take to develop this computer. He still didn’t tell me what my job would be and I never asked – but still I assumed I was to be the top engineering guy. After all, my expertise at HP was managing large computer projects and I had recently successfully manage the turnaround of the HP 3000 – a product that initially failed but then was rescued and subsequently became one of the most successful minicomputers ever.

I spent about a week putting together flowcharts and spreadsheets that covered all that would be necessary for the new computer – hardware, software, user manuals, etc. Jim came by my house in Saratoga and I laid out my plans. I don’t remember the details – I wish I had saved them. But it must’ve been something similar to what I would have done HP — the numbers of people, the length of time — along the lines of a typical Hewlett-Packard engineering project. I certainly was not thinking in terms of a startup, where everything has to be done quickly at minimal cost – cutting corners when necessary. I was not in startup mode.

Whatever I showed Jim must not have impressed him because that was the last time I saw him. I never heard another word. (Actually, the next time I saw Jim was at a financial analyst meeting in 1982 when someone suggested we put a Tandem and Stratus side-by-side, shoot them with machine guns, see which one survived.) I never called Jim — I never pursued it. I think I was a little bit relieved by not having to risk my great HP career and the well-being of my family. I was soft and happy where I was.

I had forgotten about the whole episode until about a month later Mike Green sauntered into my cubicle. There was no question that Mike was the star engineer at HP’s computer division. He was the best of the best. Mike had hired me back in 1969 to do math software for the new secret Omega project. By 1973 we had switched roles and I was now a manager and he was back doing what he did best, designing and inventing.

Mike told me he was resigning. This was a shocker. Nobody ever left HP back then. I mean nobody. Besides, if you were a computer engineer where would you go? HP was the only computer company in The Valley. You’d have to go back east to join Digital Equipment or Data General. Nobody was moving from California to the East Coast back then – in fact they seldom do today.

I asked Mike where was he going. He said he couldn’t tell me — it was a secret. Very, very strange… Why a secret? It felt odd. So, Mike gave his two weeks notice and I got some flack from my bosses, particularly Dick Hackborn, wondering how I could let the superstar of our computer design group slip through HP’s grip.

A couple of weeks later a bombshell exploded inside our Cupertino office. Around 10 of our best hardware and software engineers up and resigned all at once. They all worked for me in my department. One of them told me they were joining Mike to start a new computer company, and it was financed by Kleiner Perkins. I felt like a fool. How could I not have guessed where Mike was going? And if all these great stars were joining Mike, Treybig, and Perkins —what did that say about me?

I was in denial – I couldn’t accept that they would be successful. I was too jealous – too envious. My standard comment to anyone who would listen was “sure they’re all good guys. But they’re good at starting things – they’re not very good finishers.” Of course that was all bs – each of them had been a part of a very successful product at HP. Mike Green had led the team that turned around the failing HP 3000 and made it into an extremely successful product. I began to feel that I let the opportunity of a lifetime slip through my fingers.

And so life went on. I continued to run the HP 3000 development lab, albeit with most of our stars now gone. I didn't think too much about Green and the boys until they announced the name of their company. Tandem Computers!! Perfect!! Telco had been running systems in tandem for decades, and telco is where the idea came from.

They were shipping computers in 1976 by the time I got the fateful call from Data General with the opportunity to move east and become a key player in an exciting young company. I continued to follow Tandem’s progress closely and went to all the trade shows where they showed off their machine. Tandem quickly became the star company in the computing world. And I was full of envy.

The thing that always puzzled me, and puzzles me to this day, is what happened to the guys with the idea? The two engineers who came to Kleiner Perkins. There was never any mention of them – they had disappeared off the face of the earth. These two anonymous visionaries not only came up with the idea that spawned the fault-tolerant industry, but they also saved the fledgling Kleiner Perkins venture-capital firm. Tandem was Kleiner Perkins first success – they had been struggling. Years later in a documentary on Silicon Valley Perkins said that his vc company probably would have failed if Tandem had not come along.

In the long run screwing up this opportunity was the best thing that happened to my career. I never would have started Stratus, probably never would have been the CEO of any high-tech company. But at the time in the late 70’s I felt like a total fool.

Ramble Tamble

“I HATE tall, thin, white men…”

Whoa!! That got my attention!

“… because…”

I had to hear the rest.

“…they have all the advantages!”

What’s she talking about? Me? I never had any advantages! I’ve worked for all that I’ve got! My appearance had nothing do to with it. Who needs “tall”? How about Napoleon? Or Truman? Or… Gary Coleman? Ok, he probably doesn’t count. Eddie the 3’7” baseball player from way back — how about him?

Ok, I’ll give her a break. It’s probably true that over time most leaders are tall not short. But thin? How could that help? What about Taft? He was a real porker. And TR — he was a little chunky, wasn’t he? How about Oliver Hardy? Al Roker and Kate Smith?

There are plenty of examples of successful big people. But maybe more are thin — who knows?? Skinny might be a small advantage. All right then, what about being a white — is that an advantage? Well, unfortunately that’s a no-brainer in our society. And man vs. woman — no contest, again.

That got me to thinking — instead of being a tall, skinny, white boy from Berkeley, what if I were a short, fat, black lady from Tupelo? Would I be where I am — leader of a really cool computer company? No way!!

I was listening to NPR while driving to work in the early 90’s when this lady’s voice woke me up. Not really listening— I was mostly stewing over another #&#&(@#@*^ end of the quarter. That damn hockey stick. We’d been public since ’83, and all but a few quarters had been nail biters. Why do so many sales happen the last few days of that silly 3-month measuring period?

The point of all this is: looking back, it’s clear now that I was delusional when I tried to start Stratus. I thought I could do it myself. I would go out and get a bunch of investors excited about my plan, then put a team together and get things going. I could do this because I was such great, accomplished computer guy. Former VP at Data General, and before that in charge of development for HP’s highly successful HP 3000. How could they resist?

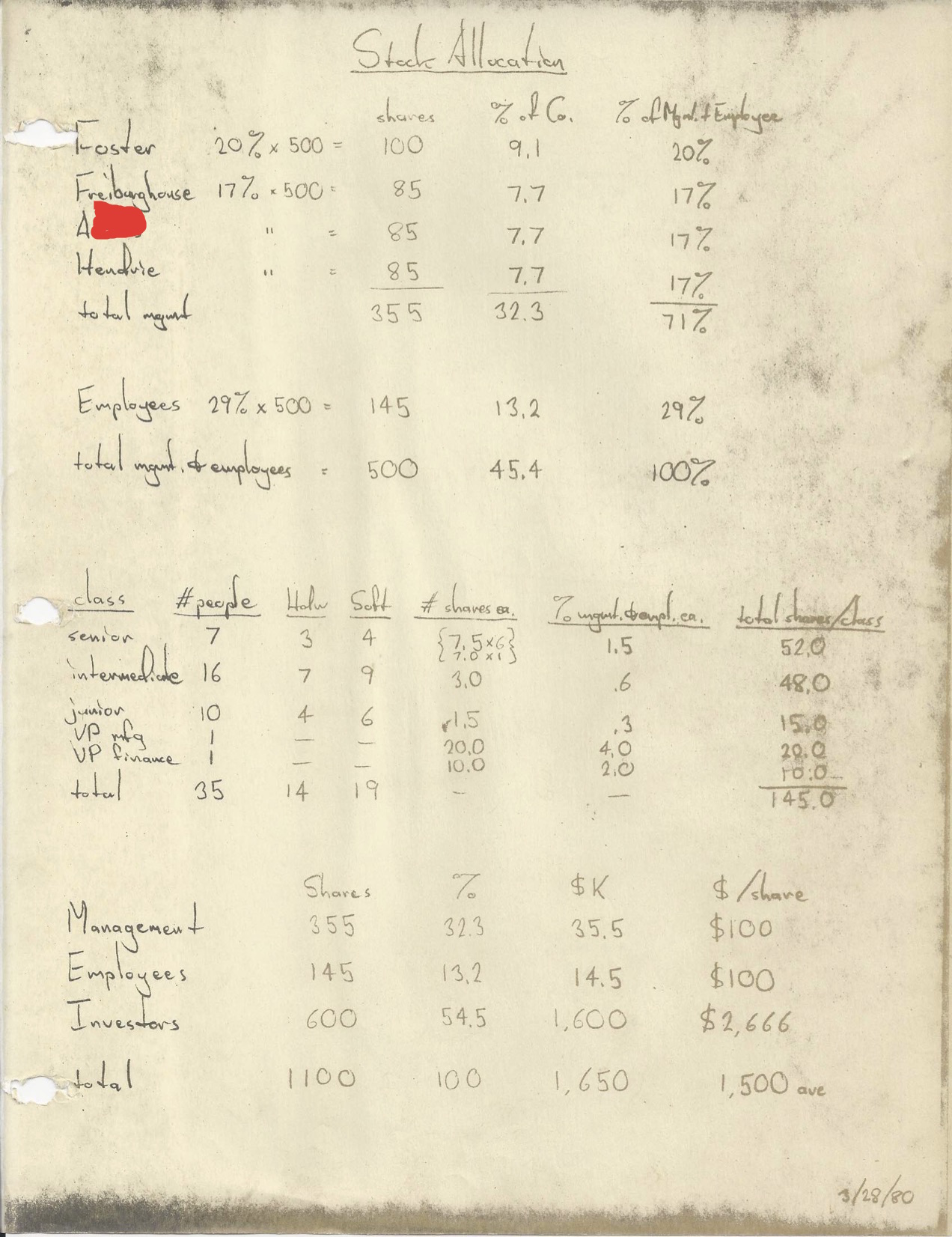

I’d published about a hundred business plans, four versions, during the fall of 1979. The vast majority went to potential investors, not team members. My co-founder Bob Freiburghouse didn’t get a plan until November, and Gardner Hendrie, the third founder, not until December!! Clearly I didn’t have a clue about how you raise money for a big venture like a computer company. I thought “they” would just hand me the cash. The result was I wasted a whole bunch of time during the first few months of my attempts to launch a company.

But in hindsight it wasn’t all bad. If things had happened more quickly the technology wouldn’t have been there — specifically the Motorola 68000 processor chip. I didn’t know it at the time but ultimately the entire plan hinged on that chip, and when we finally did get going we were on the leading edge — one of the first to use it.

This gets me to one of my pet peeves. And jealousies. Let’s face it — I’m a one-hit wonder. I’ve only started one successful company. (I won’t totally count myself out —maybe there’s still time for another. All I need is an idea…..) I am totally impressed by so called “serial entrepreneurs”. Folks that have done it 2 or more times. And I don’t mean failures — folks who have started 2 or more successful technology companies. They are really something. To have an idea for a product or service that some big market actually wants — and to do that more than once! It’s amazing.

On top of this, it takes a certain amount of luck and timing to get a successful company off the ground. I don’t care what anyone says, no one did it all by themselves. Someone helped them, or some thing — like a key piece of technology. Or a competitor really screwing up. Or popping out as a tall, thin, white baby during the middle of the 20th century— not in Somalia or some other third world country, but the good old USA. Talk about luck! Talk about something you had no control over!!

I’m really bugged by people, particularly in the tech industry, who were part of one successful startup and then figured it was all about them — they did it. They had the power, brains, foresight, and could easily do it again. Frequently their next ventures have really telling names, like “Fortune Systems” (we’re going to make a fortune) or “Stellar” (we are the brightest) or, and this is the best, “Encore”. That was formed by three luminaries in the computer business. These men were so exceptional on their own, just imagine how great they would be as a team!! They could not miss.

Don’t fool yourself into thinking that venture capitalists are smart. They’re not — at least, not any smarter than the rest of us. They get snowed and enamored just like the common folk. Some of these idiots poured money into Encore, a company whose parking lot looked like a Rolls Royce dealership. It was so top heavy with high paid managers there was little money left for workers. I don’t think anything useful was ever salvaged out of the millions that when down the drain with Encore. But I’m not picking on them — there are plenty others. I’m just trying to point out how tough it is to do it again, how your ego needs to be grounded, and how much of what goes into a big success has to do with luck and timing.

Another one: “Trilogy” by Gene Amdahl. I guess he called it by that name because first he was highly successful at IBM, then he started and succeeded at Amdahl, the first IBM knock-off company, and Trilogy would be his third time. He managed to take the company public without a product!! Shows how much the world fell for his self-aggrandizement. Amdahl must have come back to earth when Trilogy went belly up. Ironically, we at Stratus benefited from Amdahl's excesses — we wound up buying his beautiful manufacturing plant outside of Dublin Ireland to be used as our international manufacturing division. It was spectacular!! — huge offices, gilded railings on circular staircase, etc. We actually had to spend money erasing some of the opulence. Or, rather, the Irish government did. They gave us a pretty sweet deal to start a plant in their country in the late 80’s.

My bottom line on all of this: people who start more than one successful high-tech company are pretty amazing. I am totally envious. And NOBODY did it all by themselves. Consider Hewlett and Packard — and their mentor Dr. Terman who got Bill to drag Dave back west from GE in Schenectady to start a company. And WW II didn’t hurt their business much.

Gardner and Bob happy. Everything on track!

Or Steve Jobs — where would he be without The Woz? Or Bill Gates without Gary Kildall? Who, you say? Kildall will be remembered for having made the worst business decision in the HISTORY OF THE UNIVERSE!!! He wouldn’t sign IBM’s confidentially agreement when they tried to buy his operating system in 1979! Or rather, his wife wouldn’t sign — good old Gary was out flying his airplane. As a consequence IBM had to more or less force Bill Gates to provide them with an OS for their new personal computer. So Billy Boy bought an awful piece of code - QDOS— then patched it up a little, and the rest is history. Where would Bill be without Gary?

Which leads me to the other Bill. Call me Little Bill. Where would I be without: first, my wonderful wife Marian. Second Bob Freiburghouse. Third Gardner Hendrie. Nowhere, that’s where. Zip zero.

I know I’m rambling but I had a few things to say before starting on Stratus.

Bob and Bill with our first shipment. Gardner had just bonked his head on the burn-in oven!

The End of the Beginning

By the spring of 1978 I was in a real funk. I loved my job at DG but I was restless. Tandem was riding high — they were the talk of the computing world. I was totally jealous of my old friends. These guys were now rich and famous!! If I had tried harder in 1974 I could have been a founder of Tandem!! I screwed up royally!!

Ok, so what do I do? Start a computer company?? Is that even possible? Well, my friends showed me that it was — I was as good as the Tandem guys and look what they had achieved! And look at DG — a highly successful company run by some smart guys with quirky ideas that broke all the rules. Really, if the DG and Tandem folks could do it, why not me?

I am a note taker. And a note saver. I still have notes from staff meetings at HP in 1972!! The notes for “Nimbus” begin in March of 1978. (For some reason even back then I glommed on to the idea of naming my company after a type of cloud.)

I would need money, and an idea. The idea department was pretty empty back then. I would start a company to go after DEC, HP, DG, Prime, and Tandem. It would be a “low cost, 32-bit, virtual memory machine with a fast commercial instruction set.” Pretty weak. Nothing really new. No breakthroughs. So, most of the notes focus on staffing, schedules, and financing.

I knew this whole idea was pretty lame from the get-go. But by June of ’78 my focus began to change. I would go after Tandem. Strictly Tandem and the market they created — “non-stop” computers. The only improvements over Tandem that I could come up with were: “less application work to provide non-stop”, and “repair the system on the fly.” Plus, I now was a considering a 48 bit word. But none of that was very exciting. There still wasn’t the Technical Contribution -- the big idea that Dave Packard constantly preached about.

On the money side I got a list of the current venture capital companies, both East and West coast. And I figured that some of my University of Santa Clara business school professors might have an idea for funding — I was going to look them up.

In June of 1978 I flew my beat-up ten year old Cessna down to New Jersey to attend the National Computer Conference in New York City. I went right to the Tandem booth and got a nice demo from Dennis McEvoy. Their operating system was basically HP’s MPE, their language was HP’s SPL. I knew that stuff inside and out. This was the first time I touched their hardware -- the computer looked like a tank. Very rugged.

DG was doing nothing about this new market even though Tandem was getting all the headlines and a lot of new business. As far as I could tell HP, IBM, DEC, and all the others weren’t doing anything either.

This was back in the days before apps. You didn’t download free or nearly free stuff from the app store. Back then the customer wrote his own application software, or hired someone to do it. These applications only ran on one type of a computer. A DEC app would not run on DG or HP, etc. One of the first to break this rule was Gene Amdahl. His company made clones of the IBM 360 — his machines could run IBM software. Naturally IBM hated this and did all they could to make Amdahl’s life a living hell.

I figured that for DG or anyone else to go after Tandem they would have to come up with a product that was incompatible with their current line. The customer base would hate that and maybe jump ship — particularly DG’s customers who didn’t have a strong amount of loyalty. So it was unlikely that Tandem’s first threat would come from an older company. (I was wrong about this. It turned out there was a way to make a non-stop computer that was ran old software. But I hadn’t figured that out yet.)

We had a great family vacation planned for the summer of ’78. We went to a little island in the Bahamas — Harbor Island. Two weeks. I was determined to spend much of that time thinking. My real problem, the thing that was ultimately holding me back, was Dave Packard. His big booming voice constantly rattled around in my tiny brain: “YOU MUST MAKE A TECHNICAL CONTRIBUTION!!”

Oh crap, really? Can’t I just try to improve on Tandem? Isn’t 32-bits or maybe 48 enough?

“NO!! IF YOU DON’T COME UP WITH SOMETHING REALLY DIFFERENT YOU WILL FAIL!!!”

Double crap. What can I do that is new and different and better?

For two weeks, whenever I wasn’t playing with the family or doing other fun stuff, I thought, churned, mulled. When the vacation was over I had nothing. Nada. Zip-zero. Big time depression set in. It wasn’t going to happen. Not in this lifetime. I was never going to start company. Tandem would continue to prosper and I would be stuck in this place, in charge of a project that was going to fail. I gave up.

Nothing much exciting happened until the following summer. FHP continued to go nowhere, but surprisingly no one seemed to care. Ed never put pressure on me — never said “Foster, get that thing on track or you’re fired!” I’m really surprised he never leaned on me hard. By the time I left DG the project was at least 4 years old -- I'm not sure exactly when it started. Even at friendly old HP something would have happened by then. At minimum the project manager would have been replaced, or the entire thing would have been canceled. At DG nothing. Nada. Just keep pouring good money down a rat hole. I have no idea when they finally pulled the plug on FHP -- I was long gone.

Eagle, the 32-bit Eclipse, was making good progress. My software team did some amazing things to morph the old 16-bit software into something that would work. Tom West and his boys were strutting around, naturally happy that they were saving DG’s butt. Every time FHP missed another milestone West strutted a little higher.

Getting David Packard’s Monkey Of My Back

In June of ’79 I decided to try once again. Try for an idea. I need something, anything…. Ok, Tandem is the only fault tolerant company. They have a good product, but what is wrong with it? What don’t people like about Tandem? Maybe that’s how to attack the problem.

The most obvious problem was that their systems were hard to program. Basically, a Tandem system consisted of two or more computers connected together with a high speed bus. To achieve reliability the computers would “checkpoint” each other now and then. Computer A would work on a problem for a while, then when instructed by the application program it would send information over to Computer B. Likewise, B would send it’s stuff to A now and then. That way if either computer failed the other would always know what it’s partner had been doing, and carry on.

It was a good idea. But it was complex. Their operating system, the morphed MPE taken from HP, needed extensive modifications to make checkpointing work. But the worst thing was that the customer’s application had to actually perform the checkpointing commands — the app had to be designed for a feature that only existed on Tandem. These commands had really friendly sounding names, such as CHECKOPEN, CHECKMONITOR, CHECKSWITCH, GETSYNCHINFO, etc, etc. It was a royal pain for a programmer to work all of those commands into the application. And it meant that you couldn’t take an app from an IBM 360 or some other machine and move it over — it had to be extensively modified, or worse, rewritten.

I knew the trends. Software was becoming a problem. Software budgets were getting large. Businesses were beginning to spend more on software than hardware. A paradigm shift was happening. Historically the cost of hardware had far outweighed software. If I could come up with a scheme (“gimmick” as my friend John Couch would later call it) that eliminated all that extra software — well, that would be a breakthrough.

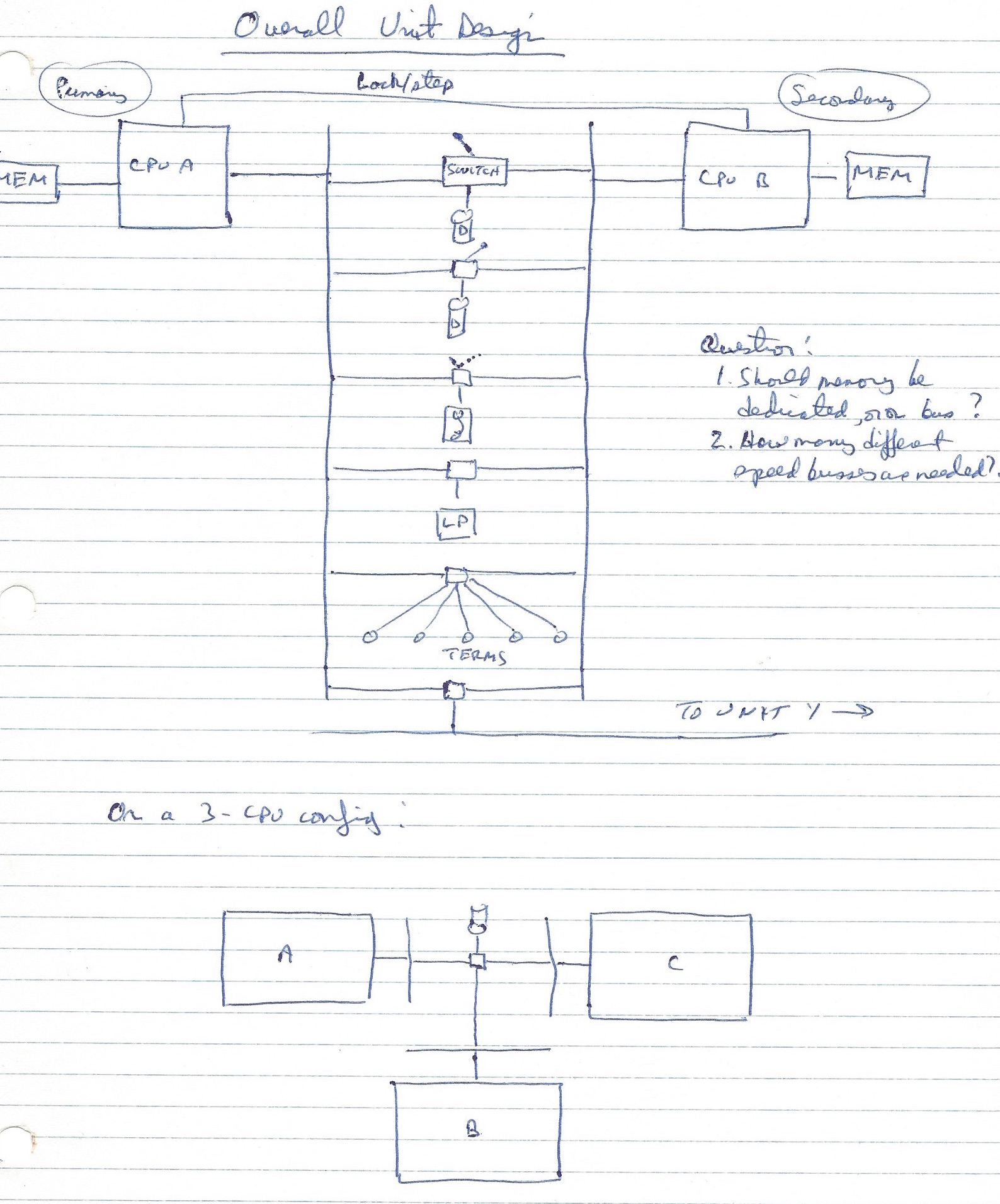

But how could you make a non-stop computer look like a normal one? Ok!! How about two computers?? Two computers running the same program??? After all, the cost of logic, the jelly beans that computers are made of, was dropping very fast. Why not just have two computers work on the same problem at once? It sounded wasteful, but it made things so simple. Maybe this is the beginning of an idea…..

The principle of doing non-stop in hardware, which on the surface seems pretty obvious, was the basis for my Big Idea. Tandem did their’s with software — my scheme would use hardware. It was just a glimmer of an idea and needed a lot of work. But it was a start. This very simple but major difference finally got Dave Packard off my back. Free at last!!!

Ideas were coming fast and furious. I figured I better start writing things down. I had a composition notebook that was always with me at DG as I went to meetings and such. It was small and easy to carry around. It allowed me to keep a record — so I that could look back and see how badly we were missing schedules, etc. So, for the dream company I called "Nimbus" I simply flipped this book upside down and backwards and starting writing on the back side of the pages. The front side was Data General. The back side was Nimbus. DG, Nimbus. Old world, new world. Old shit, new shit. Boredom, excitement. It was easy to flip from one world to the next.

This was actually a pretty dumb move considering that I worked for The Bastards, the toughest computer company ever. If my notes were ever discovered they would string me up. People would come to work one morning and there would be Bill, hanging by his neck on the flag pole, between Old Glory and the North Carolina state flag.

But never mind. I’m a risk taker. I ride motorcycles and fly airplanes. As a teenager I climbed Half Dome and sat on the ledge at the top with my legs dangling over, 3000 feet straight down. Dumb. And later that summer my buddies and I climbed the Golden Gate Bridge, from the base of the tower on up. Really, really dumb!! If I could do that dumb stuff then I could take the risk of walking around DG with these notes.

On the way to work each morning for the next two weeks I began pulling over at a secluded spot in the town of Ashland — home of the electric clock. (There are many iconic places where historic things happened in good old New England.) I found a spot deep in the woods where I could park and no one would see me. All the ideas that had come to me in the middle of the night I wrote down before I lost them.

Holy Grail

I’m glad that I kept that notebook. It is extremely revealing — my very early thoughts about something that would eventually become Stratus. The first entry was June 10, 1979. The last was on June 24. The most productive two weeks of my business life! The first entry was a list 20 or so people that I would try to recruit as partners. All from HP — I was going back to California.

The list included Bob Miyakusu, John Welch, Len Shar, Gary Smith, John Sell, John Couch, Phil Sakakihara, Terry Opdendyk, and a few others. All really great guys, people who I liked and respected immensely. I would look them up as soon as I traveled west. Little did I know then that only a few would have any interest. By the summer of 1979 most of the best engineers had moved on — had left HP for Tandem or Apple or some other Silicon Valley startup.

On the next morning, on June 11, I pulled over to my spot in Ashland and wrote down in my little notebook the advantages of having two computers work on the same problem simultaneously:

1. No application impact!!!

2. Takes advantage of the most rapidly decreasing components: memory, logic!

3. Simplicity.

4. Can make use of software not designed for fault tolerance!!

This last point was somewhat groundbreaking. Doing non-stop with hardware solved one huge problem that prevented current companies from going after Tandem: backwards compatibility. If done right, you could strap any two machines together — DEC, or HP, or (gulp) Data General. But they would look like one computer to the software! The non-stop offering would be totally compatible with the old product lines. Customers would not revolt!

For the next 12 days I worked on refining this concept. Improving it. Asking questions, such as how often do I compare the two computers? Every minute or so? Every few instructions? Every instruction? I wrote down “run them in lockstep” but since I was not a hardware guy I didn’t know how to do this, or even if it was possible. I even considered strapping a couple of IBM System 38’s together. This way Nimbus wouldn’t have to invent a bunch of new hardware or software.

The other big question was: how do you know when a computer fails? What if it doesn’t just crash? What if it keeps running but just produces the wrong answer? What if one says 2 plus 3 equals 5 and the other says it equals 6?? Who do you believe?? Well, how about a third computer to break the tie?

The concept of three computers voting was not new — it had been written about in various publications for years. The idea was simple: have three computers work on the same problem, then vote on the answer. If there’s a disagreement majority wins. I had remembered a mention of voting in the Journal of the ACM. (Association for Computing Machinery, a geek organization I have belonged to for almost 50 years!) I looked through some old issues and sure enough, there it was! The ACM referenced an IBM article going back to 1962 that described voting. They mentioned that the famous Hungarian mathematician John Von Neumann had describe it a couple of decades earlier. I was also aware of a Silicon Valley startup called Magnuson that attempted a voting product but failed. So this was all public domain stuff — I was just re-hashing a very old concept.

I continued to toy with the idea, and started to figure out how many people this would take. I had ten people for software, 6 for hardware, and 3 for documentation. I would need 19 people for the first machine.

Notebook entry for June 21, 1979. Idea # 7. “Get Fortran, PL/1 from Freiburghouse.”

That would be Bob Freiburghouse, proprietor of his own small software company, Translation Systems. At DG we licensed Bob’s PL/1 complier — that’s how I knew him. This seemingly minor entry, almost a footnote, proved to be huge. Throw out everything else in my notebook except do it in hardware and talk to Bob. 99% of the value of what I had done so far was in those two decisions.

My last entry was June 24, just two weeks after I started taking notes. I had finally settled on voting — that was the way to go. Still, it seemed really expensive — maybe fault tolerance should just be an option? Maybe the customer could buy the extra processors only if non-stop was really, really important.

Looking back, I was wrong about voting. Hardware was still too expensive in 1979 to justify three conventional computers working on the same problem, except perhaps for a very tiny and uninteresting market. My Big Idea would have failed. But well after I left DG a technology breakthrough occurred — a powerful computer-on-a-chip became available from Motorola. This made the voting viable.

Need a miracle to solve voter redundancy problem

I did have one annoying little note on this last page: “no redundancy” with an arrow pointing to the voter. This plan had one big flaw: what if the voter fails? The voter was an obvious weak link. The whole idea of a non-stop computer is that no single component failure could bring the entire system down. How about two voters? But what if the voters disagree — who do you believe? IBM had a solution in their 1962 paper but it was hopelessly complex and extremely expensive. Ever see the cartoon of the mad scientist at the blackboard? A very complex equation, and he is asked to explain the little note in the middle: “And then a miracle occurs.” That was my thought — don’t worry about it now, somehow a miracle will occur.

Finally I was excited about something. But wait! I’ve got that DG employment agreement — every synapse in my brain belongs to them — or at least that was their claim. I knew there was no invention here — that Data General could never claim they owned the idea. But the only way to move ahead with a clear conscience was to quit and strike out on my own. I decided to put everything on hold until I was free and clear of DG. Hmm… Three small kids. Limited resources. No outside source of income. Maybe I should slow down, think about this for a little bit. One thing for sure — no more work on Nimbus. Once again, everything ground to a halt. Chicken.

A few days later I was sent to Europe to talk to our people about 32-bits and what we were doing about it. Everyone knew we were late to the market and employees were becoming concerned, so it was decided that we should open up a little about our plans. In the middle of my first night in England I suddenly popped awake. There was a voice in my head. “Just do it. Go home, quit DG, and just try, for crying out loud! You have the beginnings of an idea. You’re excited about it. JUST DO IT!!!”

An ugly little red devil had appeared on my shoulder. “COWARD. DO IT!!”

And then an angel popped up on the other side. “It’s too risky. You have a wife and three little kids to worry about. How could you think of leaving a great job?” (sob, sob)

“OH SHUT UP!! HE’S GOT NOTHING TO LOSE. THE WORST THING THAT HAPPENS IS HE FAILS! SO WHAT? JUST DO IT, CHICKEN!!”

The devil won out. I waited for morning to arrive in Boston and called Marian. When I told her I was going to quit start a computer company she said “Ok, whatever, see you later.” She wasn’t too excited — she had heard this from me before, with no action.

Miss Bottom Line 1979

Everything happened quickly after that. I got home, typed up my resignation letter. Marian asked how long we could live on our savings. About a year. “Ok, I’ll keep track of the cash and when we’re a month away from being broke I’ll tell you to get a job.” No complaints — just the facts. Marian was and is a bottom line person. “The bottom line is: when we’re almost broke you go get a job. Up until then I am totally with you.” Great! We’re about to spend our life savings, all the money we had for the kid’s college fund — and she never complained. Total support from day one! Could you imagine how impossible this would have been if she had said, “OMG we have three small kids and you’re going to waste our life savings! How could you consider doing this?!!”

Next morning I walked into Ed’s office. “Ed, I’m resigning — here’s my letter giving two weeks notice.”

“Why?”

“I’m going to start a computer company.”

“Where?”

“Back home. The West Coast. I’m going back to California.”

“All right.”

That was it. He was friendly, almost supportive. He didn't kick me out like Hewlett Packard had done!! Herb was right -- DG is fair!!!

Electronic News 9/3/79

I went back to my office and sat. I didn’t tell anybody. I figured Ed would. A week went by. Nothing. Ten days, nothing. Nobody seemed to know. It was business as usual. On my final day I waited for Ed to arrive and asked what the plan was. “Steve Gaal is replacing you. Good luck.” Steve was a really good guy — this was a great choice. But more importantly, Ed wished me good luck!! Fantastic! Maybe he’ll leave me alone…

Well, he didn’t. The first lawsuit threat came just a few months later. The second was just after we closed our initial financing. The final threat came in 1981.

Call Me Flounder

I was totally down in the dumps in the fall of ’79. It had been three months since I left DG and everything was going wrong. I had bombed in California. I had no partners. I was a total failure at raising money — none of the venture people said no, but nobody said yes. They were stringing me along and Marian and I were closely watching our remaining cash. I avoided everyone — friends, family. I didn’t want people knowing how bad things were.

Fred Adler was the initial investor in Data General. He was responsible for raising $800k in two segments — that’s all they needed to get to a public offering. I had met Fred a few times while working for Ed. Apparently he was keeping tabs on my failing effort. I got a call out of the blue. “Bill, I understand you’re having trouble raising money. Send me a copy of your business plan and if it looks good I might invest.”

Once again the ugly devil popped up on my shoulder. “Don’t do it!!! He can’t be trusted!!”

The cute little angel appeared on the other side and meekly said, “But you’re not getting anywhere. You’re eating through all of your savings. What about your poor little wife and kids?” (sob, sob)

“It doesn’t matter. DON’T DO IT!!!!”

I tend to trust people. That’s where I start. But sometimes it backfires. Remember that classic scene in Animal House when the frat-brats trashed Flounder’s car? “Flounder, don't look so depressed. You f...ed up. YOU TRUSTED US!!!” Just call me Flounder. I knew it was dangerous to send Adler my plan, but I was desperate. The angel won out. I mailed my plan off to his office in New York. I screwed up.

Several weeks later I was chopping wood in our back yard. We had a ton of oak trees and my plan was save some cash and heat our house that winter with wood. Our daughter Robin called out, “Dad, phone call. His name is Mr. Kaplan.” Wow! Carl Kaplan. One of Adler’s lawyers. I had met him a few times in New York and liked him — he seemed like a really good guy, a real straight arrow. My heart jumped. This might be it!! They’re going to invest! My dream might actually come true!

It didn’t take long for my hopes to be crushed.

“Hi Carl, how’s it going?”

He got right to the point. “Bill, thanks for the business plan. Looks like a great idea. But don’t get too excited. We’re going to sue you.”

“WHAT!!!!”

“We’re going to sue you for Breach of Fiduciary Responsibility.”

Wow! Talk about going from a high to a low in about a nanosecond!! I was totally bummed.

“What in the hell is this fiduciary crap?”

“We’re going to say that you’re supporting yourself by selling names of employees to headhunters. You’re selling inside information.”

“But it’s a lie — total bullshit. And it’s absurd — no one will believe you.”

“That doesn't matter. Just suing you will scare off all the venture guys. So give it up — unless you want a lawsuit on your hands. You’re never going to get any money.”

After Kaplan hung up big time depression set in. I figured this was just about the worst day in my life. But as happens often, it was a turning point. For the positive. The shackles were off. I had nothing to lose. This threat gave me the freedom to move ahead.

These guys really screwed up! They had my plan and did nothing with it except threaten me. They had the plan for a company to go after Tandem — the hottest and most exciting computer company in 1979. They had a chance to invest and make a lot of money but instead they chose to intimidate.

Steve, Jim, Mike, and Brian with our first machine

Ken, Mike, Larry, and Brian. The first shipment is close!

Contract signing for the West LynnCreamery

Timing is everything

1980 was a great year to start a computer company. Venture capital was becoming more plentiful. A lower capital gains tax made these investments more profitable, and much more money was available than during the '70's. Plus, a fantastic new technology was on the horizon — a very powerful CPU on a chip, powerful enough to make a “real” computer. Finally, the job market for engineers was very good — which meant there was less risk for quitting and joining a startup, even if the risks of failure were high.

The old model of what it took to be successful in computers still applied. Lock in your customers with your design. Put unique features in your operating system and languages to make it nearly impossible to switch from one company to another. Free wheeling — the hardware and software engineers could do almost anything. There was no such thing as “open” computing — that term wasn’t coined until Sun Microsystems came along years later.

When computing first happened in the ’50’s and ’60’s every manufacture had its own unique design. An IBM computer was totally different from a Univac, which was different from CDC, Xerox, Honeywell, etc. It was basically impossible to take a program from one company's computer and run it on another, without a total re-write. Even within a manufacturer's own product line there was no compatibility. Something written for a CDC 160A would not run on a CDC 3600. An IBM 7090 looked nothing like the old 701.

From IBM archives

That changed in 1964 with the IBM 360 line. For the first time a “family” of computers was offered, with different levels of power and cost, but with the very important feature of software compatibility. Initially there were 6 members of the 360 family: the models 30, 40, 50, 60, 62, and 70. Eventually there would be more models, and later the IBM 370 family. The unique thing about the 360 was that programs written for one model would run on all the rest. This was groundbreaking. IBM could lock their customers in. Stay within the 360 family — why go to the expense of switching to CDC or whomever? That would cost you a rewrite of your software. Just stay with us and move up the IBM product line. (Programs written on those old IBM 360 computers still work on today's IBM mainframes.)

Eventually everyone came out with their own family of computers. But, each company's family was different from the others. There was no simple way to move programs from IBM to CDC to RCA to GE, etc. You had to be really pissed off at your vendor to go to that expense.

This was still the environment when we started in 1980. There was no standard instruction set or operating system. There had been some progress in making the key programming languages standard — Cobol, Fortran, etc. But with a few tricky operating system features it was still relatively easy for the computer manufacturer to lock their customers to their design.

So, if you started a new computer company in the early ’80’s you didn’t have to worry about compatibility. You could use whatever instruction set that you wanted. And invent your own operating system if you had access to the few number of people who could do that. In other words, you could be different. You could differentiate. Since a new company didn’t have any old customers, backward compatibility was not an issue. The engineers could be free. It was the best environment for inventing creative hardware and software and it was a perfect time to start a new computer company.

Road Trip

Ok, you’ve just quit your job. Five mouths to feed, trying to maintain a middle class life style, very limited cash, no money coming in, and a pipe-dream about starting a computer company. What to do next??? Easy!!! ROAD TRIP!!!

In late July 1979 we all piled in to our yellow Chevy van — the one I bought while at HP three years earlier and was still making payments on. It just seemed like the thing to do — take some time off, relax with Marian and our kids. I was pretty sure the next couple of years would be intense, so why not chill for a short while?

We drove to Montreal, camped in Vermont, and generally had a swell family va-cay for about 10 days. I have always believed in vacations and have always taken them. Marian and I have always been vagabonds, enjoyed traveling, loving to see this great big country of ours.

When we got back it was time to get to work. I had many of the ideas for a business plan in my head and began writing things down. This is where my MBA from Santa Clara really paid off. I wouldn’t have had a clue about how to do a business plan with out it. Or how to read financial statements, understand the difference between a balance sheet and an income statement, etc. They don’t teach that stuff to math geeks. Some say that much of what you learn in college is never used in your career and I agree with that for the most part. But there is no question that without the education from Santa Clara that I completed in 1974 I could not have produced a business plan on my own. There could be no outside help. I was scared shitless by Data General. I couldn’t make a move without thinking what they might do to me. So, no outsiders — just Marian and me.

How do we type it up? All we had was an old Underwood mechanical typewriter — could you imagine all the work it would take with corrections and revisions? IBM, it turns out, had a great product that we could lease — the IBM Memory Typewriter. It was basically and IBM Selectric typewriter with some type of crude processor and enough memory to store 30 pages! For 170 bucks a month I could rent the thing. And, get this: rental included an IBM service guy coming to our house once a month to check it out!! How could they make money on that deal? It just shows how IBM dominated everything back then, and they would take on a money losing deal if it meant grabbing market share, no matter how small the market.

The business plan was pretty normal — stuff you would learn at MBA school. I even had a section labeled “Technical Contribution” where I described the plan to use hardware for fault tolerance, not software. Dave Packard’s speeches about the necessity of technical contributions were still ringing in my ears.

The plan was pretty cool, I thought. But looking back it is obvious now the plan lacked one key element: people! I was the only human being named. No engineering person, no one for marketing or sales. No finance guru. They would all come later, after investors threw their cash at me.

The other big problem was that this plan would have failed. Minor detail, but no chance the product would have been a hit. I was aware of work being done on powerful microprocessors, but they weren’t here yet. Zilog was developing the Z8000 but it would have been very hard to do virtual memory with that chip. Motorola had announced something called the 68000 which looked very interesting -- it had a true 32-bit address space. But they hadn’t yet talked about deliveries. I couldn’t count on them.

My plan was to build three conventional CPU’s out of TTL (transistor-transistor logic, the de rigueur of the day), and run them in lock step. What I totally overlooked was that this would have been way too expensive — only a very small market would pay for this much triplicated hardware. The plan would not fly. This company would have failed. It's interesting that as I talked to folks about investing or joining no one picked up on the obvious problem. Maybe they were just too polite to say “Nice plan, Bill. Too bad it won’t work.” Or clueless like me.

I was going to take a page out of Tandem’s book and copy Digital Equipment’s very successful VAX machine. It was a good 32-bit machine, with lots of software that maybe I could take advantage of or steal from DEC, like my Tandem friends did to HP and the 3000 back in '74. And who needs another instruction set anyway? Why not just take one that works?

Why not copy DG’s 32-bit Eclipse, you ask? ARE YOU FRIGG’EN CRAZY????!!!!! Data General still scared the living be-Jesus out of me — I wanted nothing to do with them. I wanted to get out of town asap and get this thing going back in my native California.

It’s kind of funny, but Data General still scares me, and they disappeared decades ago after being gobbled up by EMC….

How about a name for the company? What are we going to call it? I don’t know about other entrepreneurs but I spent way too much time coming up with a name. I wasn’t going to call it Foster Computer. Foster Freeze works, and Foster Lager, but that name was no good for a computer company. Besides, putting your name on the letterhead seems egotistical.

In 1978 when I first started writing down ideas I had used “Nimbus” as a name of my fictitious company — it’s a type of cloud. But now the name seemed weird — just didn’t roll off the tongue. Ok, the year is 1979, the end of a decade, about to start a new one. How about Decade Computer? Neither I nor Marian was very excited but we went with it — at least this gave us something to put on the plan. It turns out as time went on no one liked “Decade”. “Sounds like you’ll only last 10 years”, one VC told me. Or, people thought it was “DEC-Aide”, like we were somehow aiding Digital Equipment Corp. Once my co-founders Bob and Gardner joined me months later we resolved to change the name. But, for the first 6 months of Stratus’ life it was called Decade Computer.

The business plan was coming together. Well then, how about money? A small detail, but you need a couple of million bucks to get off the ground. On my very last day at DG my friend and cohort Carl Carmen came to see me. Carl ran the hardware side of development, while I ran software. He told me about a venture capitalist in Boston by the name of Charlie Waite. The company was Greylock — old, venerable, and with a great reputation. So, as soon as we got back from our family trip I gave Charlie a call. He agreed to see me the next day, which kind of surprised me because here I was, a nobody, and this guy, who happened to also be a board member of Prime Computer, agreed to spend time with me. Cool!

They had an expensive office in downtown Boston — in one of those high rent skyscrapers that housed only elite companies. Over the next year or so I would get to know downtown Boston really well, with many visits to our lawyer, accounts, potential investors, and even early customers such as Fidelity. Downtown Boston is a really cool place. Except in the winter, when walking around the city can be downright nasty.

Charlie was a very friendly -- a genuine nice guy. I gave him my pitch. He seemed intrigued. Being a member of Prime Computer’s board meant that Charlie understood the industry pretty well, knew about Tandem, and understood the importance of improving computer reliability as the world moved away from batch processing to online computing.

I told him my plan to do this in California. He said “Well, Bill, then you’ll need a west coast lead investor. You should go see Paul Wythes and Sutter Hill in Palo Alto. I'll set it up.” Cool!! I now have a west coast connection! This is what I really needed.

“Bill, if you pull this together, get a team, and get Sutter Hill or one of the others interested, we at Greylock might be interested. But, only "might". We are a later-stage venture company and only do one start-up per year. And we have our eye on another guy at Prime Computer that we know real well — if he ever gets is act together and leaves Prime we would probably back him, not you.” Ok. That’s ok. At least I have a Silicon Valley connection. This was an extremely valuable meeting, all thanks to my friend Carl Carman.

As Charlie walked me out the door we ran into a very pleasant older gentleman, wearing a rumpled suit with his bow tie slightly askew. “Dave, meet Bill Foster. He’s going to start a computer company in California.” The man was David Place, a senior partner at a venerable Boston law firm, Gaston Snow and Ely Bartlett. They represented Greylock along with a bunch of very important companies.

Think of your kindly grandfather, or aging history professor, or small town cobbler. That was David Place — that’s what he looked like. And even as a very powerful person he was as nice as could be. I learned later that David knew everybody of importance in Boston — EVERYBODY. And to get anything done in Boston or anywhere in Massachusetts for that matter it was all about who you knew — all about connections. Well, Dave had connections up the wazoo— he could get anyone he wanted into any important door in the Commonwealth. I learned later he was even good friends with George Bush, the senior, and later worked for him in his administration. This man was connected.

Dave shook my hand in that regal way it was done in Boston — it’s hard to describe, but a light handshake with his right hand and then the left coming over the top — a two handed shake. “Congratulations, Bill. What an exciting and brave thing to do.” Congratulations? These guys were talking like I had actually achieved something. Right now I couldn't rub two nickels together.

Then he went on. “Bill, you’re going to need a law firm to represent you. I would like to do it. I would like to represent and advise you right now, no charge. If you ever get your dough (he always referred to money as “dough”) then maybe you would be so kind as to hire us as your official law firm.” This was crazy — I had only known him for about 2 minutes and he was already offering his services!! For free!! It didn’t matter that I was going to California — they had people out there. I accepted his generous offer immediately — what else? Do you think I’m crazy?!!

So, this little meeting at Greylock turned out to be tremendously important. Links to a venture capitalist in The Valley, a law firm free of charge, and a possible investor from Boston. I was one happy camper as I walked out the door. Things were starting to happen!!

Version 1. Pssst... it would have failed....

The next step was to finish the business plan. I showed what I had done to David Place. I had written the plan as if Decade already existed, and not a pipe dream. His legalese mind thought I needed a disclaimer that specifically mentioned this company didn’t yet exist. So, that was Gaston Snow’s initial contribution: this boilerplate that was stuck on the front cover of every Decade business plan — four generations worth: “This memorandum contains proprietary information ….."

Ok, how do I print it up? Well, thanks to a west coast friend more free help was on the way. An old childhood friend of Marian's was now a big wig in San Jose for one of the so called “big eight” accounting firms — Arthur Young. Ron Piziali told me to look up his counterpart at their Boston office to see if he could help. Again, another trip into Boston — I was getting to know the downtown area better all the time. I met with George Southwick, one of the nicest people ever. Very smart, very friendly. “Ron tells me you're a good guy, Bill. So that’s all I need. I’ll offer my services to review the financial part of your plan, and when you’re ready we will print it in our production department.”

More free, generous help. Amazing! George helped me produce the five year financial plan for Decade — “pro forma” is the term. This forced me to come up with a revenue goal. I had no clue how fast this thing could grow. It had to be big enough to get the VC’s interested, but not too big to look crazy. Both Prime and Tandem were public companies and all their data was available. I simply averaged the performance of those two, making adjustments here and there, and came up with a financial plan: Small revenue starting at the end of Year Two, growing quickly to $80 million by the end of the fifth year. A total swag — not based on any solid data. But the funny thing is once Stratus got off the ground we were all driven to make that $80 million goal, and we basically did it!! We achieved a number that had no basis of fact other than a wild-eyed guess concocted by looking at what Prime and Tandem had done.

Gaston Snow's boilerplate

Big accounting firms like Arthur Young produced a lot of reports. This is before the internet, before PDF files, before email. A lot of paper was used back in those days. When my plan was finally done George’s department produced 30 beautiful documents, perfectly typeset and bound in the most professional way. And it didn’t cost me a cent. I gave George the first copy!

Like Dave Place before him, all George asked in return was that Arthur Young become our accounting firm when and if we get off the ground. And, of course, they did. One of my early investors tried to get me to switch to their big rival Arthur Anderson, but no way — after all that George had done I would never leave him or his company. Tragically, about 10 years later George contracted ALS and died from that absolutely terrible disease. Gary Haroian, John Curtis and I visited George just weeks before he passed on and he was still fighting, he was still optimistic. He would not give up. What a brave man George was!!

Next step — off to California. The Valley. Frisco. (As a native of the area I love calling it "Frisco" because it annoys the natives so much.)

The Gimmick

Being on a budget, I stayed with my mom in Palo Alto. She was glad to see me — it really hurt her when we all moved east in 1976. With a PhD from Berkeley, mom had taught at various colleges during the previous 20 years, most recently at Foothills College in nearby Los Altos Hills. But she had been forcibly retired because of California’s mandatory retirement age, and now didn’t have much to keep her busy. She had sued the state over their policy but got nowhere. She had named the College’s administrator on her suit: Pitts Johnson, who ironically was also a member of Tandem’s board. My path and Pitt’s would cross later when he got upset over an advertisement that we ran about Stratus’ advantages over Tandem.

My first stop was Sutter Hill and Paul Wythes. He was great — supportive, interested, but noncommittal. What was I expecting — that he would pile cash on me the minute I walked in the door? I told Paul I would begin looking for a team — digging up old friends from my HP days. He said he would like to be involved in the interview process. That kind of bothered me — this was my deal, why should I need approval from him? But he also controlled the dough, so that was that. He offered me an office to work out of at their place — but I turned him down. That was more control over me than I wanted.

Paul helped big time in another way. There was an exciting investment banking company in San Francisco called Hambrecht and Quist. They seemed to have their fingers involved in all the good techie deals in The Valley. Wythes connected me with Bill Hambrecht. Bill invited me to lunch in “Frisco” with one of his young stars, Tom Volpe. I gave him the pitch — he was as nice as could be. H & Q was not only a VC firm but they also were an underwriter for new public offerings. Alas, he was not ready to throw any money my way — it was way too early for them. But this connection really paid off down the road. They eventually did invest in Stratus and also helped to underwrite our public offering in 1983. On top of this, Bill Hambrecht and Tom Volpe were really nice, down to earth guys, in spite of all of their success.

Next I looked up an old friend from HP who I thought would be a great candidate to run Marketing and Sales: Bill Krause. Very smart, very direct, with great experience. Bill worked with me at HP and was one of their young stars in their marketing department. Bill seemed to be quite interested. I hooked him up with Paul Wythes for his look-see. Paul called me the next day.

“Bill, I had a great meeting with Krause. He seems like an excellent candidate. But there’s one thing you should know — Krause spent most of the meeting trying to convince me that he should be the president of your company, not you.”

Hmmm… I hadn't seen that coming. So much for Krause. Apparently I needed to be a little more selective in the future. But out of the blue another sales candidate popped up. Another guy named Bill A. — seems like there are a lot of Bill’s in this story. He ran sales on the west coast for a high-flying minicomputer company. Mr. A really wanted to be in on my deal. Great!! My first partner!

Early in my HP career I hired a really good computer science grad out of Berkeley: John Couch. One of the best geeks that I knew — and he wasn’t even that geekish. But really smart. John was still at HP and I looked him up. I told him I was going to start a computer company.

The first words out of his mouth were: “What’s your gimmick?”

The Gimmick. Original notes

That caught me off guard. Set me back on my heels. Gimmick? He’s calling my baby, my brilliant idea, a gimmick??? But soon I realize it was just John’s version of Packard’s “technical contribution.” Couch knew that for any new computer company to have a chance you had to bring something new to the table. And hopefully something really worthwhile -- something that people would buy.

I explained the idea — how I was going after Tandem but would use hardware voting rather than software check-pointing. He saw right away that this was a great approach. He felt it had a chance. He liked it. But he wouldn’t sign up.

“Bill, you’re just a couple of weeks late. I’ve decided to quit HP and join Apple. They’re going to let me head up a new project.”

Bummer. John would have been great — he was not only smart but he could have pulled in a lot of really good techies with him. Apple was just getting rolling in 1979. No one had any idea where these “home computers” were going. IBM hadn’t even entered the market yet — they hadn’t yet coined the term “personal computer.” But John felt (correctly) that the market for these little boxes was going to take off.

John eventually became head of an Apple project called "Lisa". A really cool, icon-based desktop computer, very powerful. But it turned out to be too expensive for the market at that time. Steve Jobs took many of the great new innovations that Couch and his team had come up with, and put them into his lower cost pet project, the Macintosh. Much of the success of the Mac had to do with John’s work.

While I was scraping around Silicon Valley looking for warm bodies (my standards were getting lower) I also started looking at the housing market. We were going to move ourselves back to the Bay Area. While DG paid for my move to Massachusetts three years earlier, now we would be footing the bill. But worse than that, it turns out the housing market had been soaring in the Bay Area. The house we sold in Saratoga in 1976 for around 100 grand was now going for a half a million!! And our starter house, the one we bought in San Jose in 1969 for $30k now cost about 200! Meanwhile our house in New England hadn’t appreciated much at all. It dawned on me that we not only couldn’t buy our old house back but we couldn’t even afford our starter house!!

And finding people was a real struggle. In 1979 startup fever was spreading throughout the Valley. People who were still at HP had plenty of opportunities to jump ship and join a new venture. I wasn’t offering anything really new and exciting.

Depression was setting in. Cash was running out. With my tail between my legs I headed back east.

Stay East, Young Man

The best thing that happened to me in 1979 was California’s crazy booming housing market. That’s what drove me to stay east — more than the fact that I was having trouble finding people. If we had been able to afford a house in The Valley I would have moved my family back there, and then I would have failed.

1980 was a perfect time to start a company in New England. There hadn’t been a tech startup since Prime Computer in 1974. Engineers saw what was happening in the Bay Area and many were chomping at the bit to try their hand at a new venture.

Also, there’s no way I could have attracted the same quality of people that I got in Massachusetts. It started with Bob Freiburghouse’s eagerness to join me. He made the venture real. But equally important, Bob dragged in a bunch of amazing programmers — probably unparalleled in computing.

Data General began harassing me once they learned I was remaining in their territory. But that harassment lead me to Gardner Hendrie, the third member of our troika. Gardner bought some fantastic engineers that did things with hardware no one had ever done before. And he provided the critical link to our initial financing. Thanks, California, for being such an expensive place to live!

We had to develop an operating system from scratch. The OS is the riskiest and most complex part of a computing system. Tandem punted on this by stealing HP’s code. Bob and I considered briefly using Unix, but back then it simply would not cut the mustard as a commercial operating system. We had to develop it from scratch, and only Bob had the contacts with engineers that could do that. I didn’t know anyone from HP with the talent that Bob brought into our company.

But it took me a while to figure all of this out. Initially it felt like a disaster to stay east, to reset my plans. For one thing, venture capitalists don’t like change in the middle of trying to get a company going. Change means indecision, uncertainty, and indecisiveness. Does this guy know what he’s doing? That was a huge risk — abandoning the west and staying east.

I knew this would be a big setback. But I had no choice. Moving back to California was not an option. The first thing I did after punting on The Valley was to publish Version 2 of my plan. No big changes — minor tweaks. Still going down the losing path of hooking three DEC Vax-like computers together. For some reason I was still more focused on raising money than finding partners. So I started bouncing around Boston, following up on a bunch of dead-end leads, looking for dough.

One afternoon on my way home I had still had one plan left from the latest batch. On a whim I drove to Bob Freiburghouse’s office in Cambridge. My plan was to work out a deal for his compilers — hoping to get them now and pay him later. I went over the plan with Bob, drew him some simple pictures of the voting architecture. Being a software guy Bob saw right away the advantages of this approach over Tandem.

Later that evening Bob called me at home. He didn’t mix words. “Bill, I like your plan. It looks like much more opportunity than developing compliers. How would you like me as your partner?”

Holy smokes!!! This was totally out of the blue — something I never expected. Bob owned his own very successful small software company. It was very small but very successful. Just Bob and a helper. I never dreamed he would consider giving that up. In addition, he was going to give me office space. And we could use his Prime computer for development work. Unbelievable!! More than I could ever have expected. My venture finally began to look like it could become real.

Of course I accepted — are you kidding?? Right away Bob asked about a hardware guy. He knew software inside and out, but wasn’t any more of a hardware guy than I was. The plan depended on running computers in lock-step. Was that even possible? I told Bob I was working on a hardware guy and I hoped before long to have someone that he could talk to.

In fact, I had been given a lead recently. A young engineer at DG, no less, Dave B. I knew Dave and I thought he was pretty sharp. Dave had recently made the decision to leave DG and join Wang, so I figured he was fair game. Since he’s going to leave DG anyway why would they sue me?

I showed Dave the plan, went over the architecture, he liked it. “Sure we can run CPU’s in lock-step. We just hook them up to the same system clock. No problem.” This was great — the first confirmation from a hardware guy that lock-step was even possible.

Dave lived in Ashland, one town over from me, and we met several more times, going over plans and schedules. By this time Motorola had made good progress on their 68000 processor chip and I decided to use that instruction set rather than the Vax. That way when the 68000 did become available we could just drop it in with no changes to the software. I came out with Version 3 of the plan with this change to it, and dropped by a copy at Dave’s house.

I never heard from him again. Total, deafening silence from Ashland. No phone calls returned, nothing. Then the business plan showed up in my mail — Dave had mailed it back!!! Pretty sure sign he had decided not to be part of the deal. I heard later than he had been turned around by DG and decided to stay there. But he never had the courage to face me and drop out directly.

Shortly after this I got the infamous phone call from Carl Kaplan telling me DG was going to sue. Maybe the events were connected… maybe they heard I had been talking to Dave. I never determined this to be true. But, as I described in the DG chapter, the gloves were now off. I desperately needed a hardware guy. I had to keep Bob’s interest up.

Co-founder of Apollo?

Out of the blue Charlie Waite of Greylock Ventures called. “Bill, I hear you’ve decided to stay east, and you’re having trouble raising money.” Seemed like everyone in the world knew I was floundering. “ We’re going to invest in Bill Poduska. He’s leaving Prime and is going to start some type of a computer company. Why don’t you meet with Bill — maybe the two of you could work together.”

Hmmm. Not what I really wanted — potentially to be second banana in someone else’s company. But he had money, or at least was well on his way to getting it. I had nothing — just a rapidly dwindling savings account. One software partner, no one for hardware. No good venture capital leads. I wasn’t holding any cards. Sounds like I should at least meet with Poduska.

We spoke on the phone, and he was the nicest guy ever. Most people in the New England had heard of Bill. One of the founders of Prime, the hottest local computer company to come along since Data General. A minicomputer with 32 bits. Alone in the industry with that really important and forward looking feature. All computers would eventually have at least 32 bits — they needed it as memory got cheaper and software got bigger. You just could just barely design decent software with a 16-bit computer. But Prime was the first mini to have it, and they were doing well.

Bill suggested that we have a dinner with our wives. I didn’t tell my partner Bob Freiburghouse that I was going to meet with him — I felt like a traitor.

It was a great dinner and Bill was simply delightful. Funny, erudite, charming. Our wives hit it off as well. Looked promising. Except….